JPMorgan Is Undervalued - 8 minutes read

JPMorgan Is Undervalued - JPMorgan Chase & Co. (NYSE:JPM)

JPMorgan Is Undervalued - JPMorgan Chase & Co. (NYSE:JPM)JPMorgan is arguably the strongest player in the US banking sector, with remarkable competitive strengths and a proven management team.

Financial reports for the second quarter of 2019 confirm that the company is as strong as ever.

The stock is attractively valued when looking at both valuation ratios and cash distributions.

Successful investing does not need to be too complex or sophisticated. Far from that, buying high-quality stocks for attractive valuation levels can be a simple and effective strategy for superior returns over the long term.

JPMorgan (JPM) is arguably the top player among the big US banks; the company is performing remarkably well and valuation is clearly attractive for such a high-quality business. The industry is facing some uncertainties in the short term, but the long-term picture looks quite solid for investors in JPMorgan.

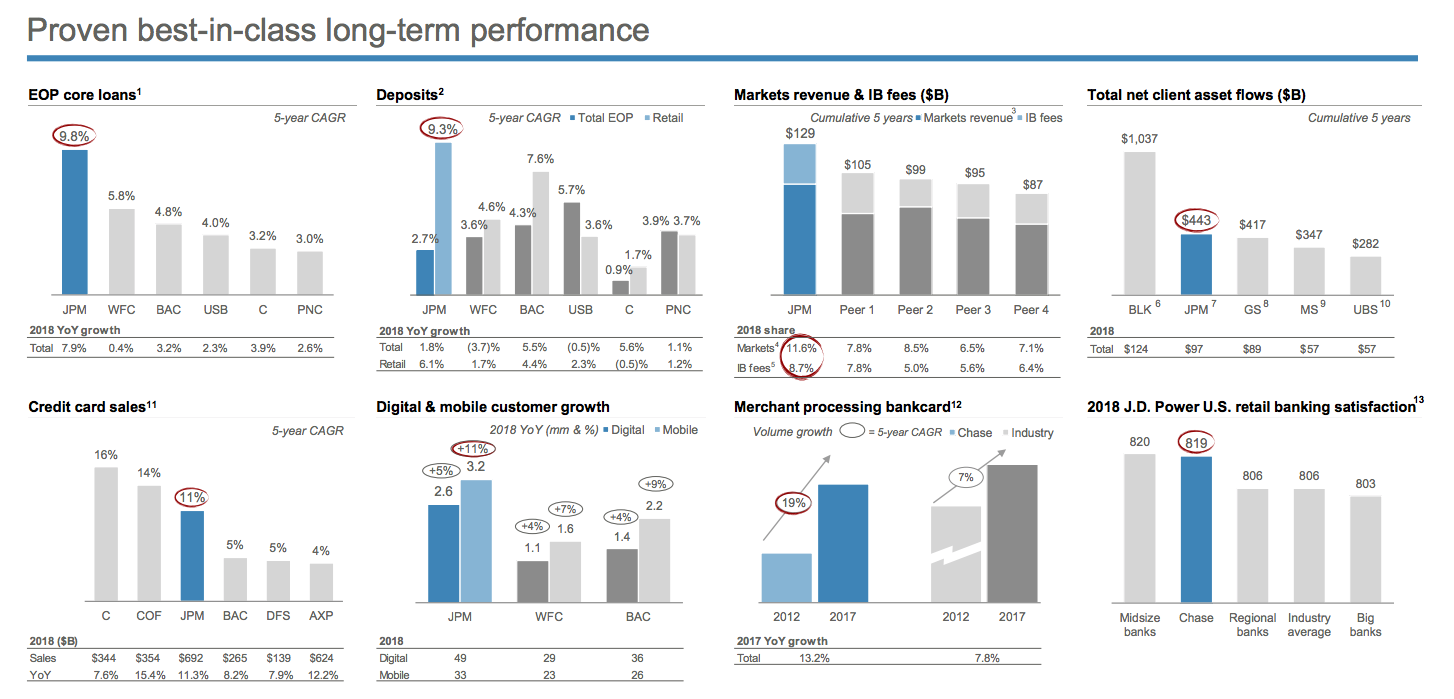

JPMorgan is the largest player in the U.S. banking system based on deposits and revenue. The company is also the top credit card issuer in the country and a leading player in investment banking and trading services on a global scale.

Massive scale and diversification in different business segments makes financial performance more stable. Besides, cross-selling opportunities generate more revenue and profits per dollar of assets for JPMorgan versus the competition. Brand recognition is a key strategic advantage in financial services, and JPMorgan comes second to none in that area.

Under the leadership of CEO Jamie Dimon, JPMorgan has emerged from the financial crisis in much better shape than its competitors, and the company has successfully leveraged on its strengths to outperform the competition in different areas over recent years.

The business keeps firing on all cylinders as of the most recent earnings report. The company reported $2.82 in earnings per share during the second quarter of 2019, surpassing Wall Street expectations by $0.33 per share. Revenue increased 4% and expenses grew by a smaller 2% during the period, so JPMorgan is benefiting from strong operating leverage and expanding profitability.

The company keeps leading the industry in terms of efficiency. The efficiency ratio - calculated as operating expenses/revenue - reached 55%, an improvement versus 56% in the second quarter of 2018. This ratio measures expenses as a percentage of revenue, so a lower ratio means higher efficiency.

Profitability levels are outstanding. Return on tangible common equity (ROTCE) reached 20% during the quarter, an increase versus 19% in the first quarter of 2019 and 17% in the second quarter of 2019.

JPMorgan has a pristine balance sheet; the company's common equity tier 1 (CET1) ratio, which compares core equity capital to total risk-weighted assets, stands at 12.2%, comfortably above the Fed's required 4.5%. This is an unquestionable sign of financial strength, and it provides plenty of resources to make all kinds of investments and reward shareholders with growing dividends and buybacks over time.

The table below compares multiple valuation metrics for JPMorgan versus the average stock in the industry. JPMorgan trades at a discount versus the industry average based on price to earnings, price to earnings growth, price to sales and price to cash flows. Only in terms of price to book value JPMorgan trades at a premium versus industry peers.

Importantly, when you look at the main profitability indicators such as return on assets, return on equity, net margin, and sales per employee, JPMorgan is well above the industry average across the board. In simple terms, the stock is priced in line or even at a discount to industry standards, but the company is clearly superior to the industry average in different areas.

It is one thing to say that a stock is attractively valued based on metrics such as price to earnings or price to revenue, since this can seem like an ephemeral and theoretical concept to many investors. But when the stock is undervalued based on the cold hard cash that the company distributes, then this undervaluation becomes far more tangible.

JPMorgan has an impressive track record of dividend growth and share buybacks over the long term. Over the past five years, the company has increased its dividend by 125% while reducing the number of shares outstanding by over 13% of the total.

Based on the Seeking Alpha dividend score metrics, JPMorgan's dividend yield is in line with the industry, but the company is far superior to the industry in terms of dividend consistency, dividend safety, and dividend growth.

JPMorgan has recently increased its quarterly dividend from $0.8 to $0.9 per share, and the company announced a new share buyback program of up to $29.4 billion between July 1, 2019 and June 30, 2020. The forward dividend yield stands at 3.16%, while the buyback program represents almost 8% of the company's market capitalization.

Assuming that the company could in fact repurchase $29.4 billion in stock over the next year at current market prices, this would represent a massive shareholder yield of 12% when considering both dividends and buybacks versus current market capitalization. Needless to say, this is a very compelling yield coming from a world-class financial institution.

The financial services industry is highly competitive and saturated, so it's not easy for a market leader such as JPMorgan to find growth opportunities that are big enough to move the needle in terms of global financial performance. Besides, profitability in the industry depends on interest rate levels and the slope of the interest rate curve to a good degree, this is a big source of uncertainty in the current environment.

But the main point is that those risk factors are already well incorporated into investors' expectations and into the stock price. Like Warren Buffett said, "Price is what you pay and value is what you get". In the case of JPMorgan, you are getting a high-quality financial institution for a conveniently low price. This looks like a solid proposition for attractive returns over the long term.

Disclosure: I am/we are long JPM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

JPMorgan Chase • New York Stock Exchange • United States dollar • Bank • Financial statement • Fiscal year • Company • Stock • Valuation (finance) • Cash • Probability distribution • Investment • Quality (business) • Stock • Valuation (finance) • JPMorgan Chase • Bank • Company • Value (ethics) • Business • Industry • Uncertainty • Term (time) • Term (time) • Investor • JPMorgan Chase • JPMorgan Chase • Bank • Deposit account • Revenue • Company • Bank • Trade • Service (economics) • Globalization • Economies of scale • Economies of scale • Diversification (finance) • Business • Market segmentation • Finance • Performance management • Cross-selling • Revenue • Profit (accounting) • United States dollar • Asset • JPMorgan Chase • Brand awareness • Financial services • JPMorgan Chase • Chief executive officer • Jamie Dimon • JPMorgan Chase • Financial crisis of 2007–2008 • Company • Competition law • Business • Company • Earnings per share • Fiscal year • Wall Street • Revenue • Expense • JPMorgan Chase • Operating leverage • Profit (accounting) • Efficiency ratio • Revenue • Revenue • Profit (accounting) • Tangible common equity • Fiscal year • Fiscal year • JPMorgan Chase • Balance sheet • Company • Tier 1 capital • Equity (finance) • Risk • Asset • Federal Reserve System • Finance • Investment • Shareholder • Dividend • Valuation (finance) • JPMorgan Chase • Stock • JPMorgan Chase • Trade (financial instrument) • Discounting • Price–earnings ratio • Price–earnings ratio • Earnings growth • Cash flow • P/B ratio • JPMorgan Chase • Trade (financial instrument) • Control premium • Profit (accounting) • Return on assets • Return on equity • Margin (finance) • JPMorgan Chase • Stock • Price–earnings ratio • Investor • Stock • Hard Cash (2002 film) • Company • Asset • JPMorgan Chase • Dividend • Dividend • Shares outstanding • Seeking Alpha • JPMorgan Chase • Dividend yield • Company • Dividend • Economic growth • JPMorgan Chase • Dividend • Company • Share repurchase • Dividend yield • Market capitalization • Company • Stock • Market price • Shareholder • Yield (finance) • Dividend • Market capitalization • Yield (finance) • Financial institution • Competitiveness • Dominance (economics) • Economic growth • Globalization • Profit (accounting) • Industry • Interest rate • Slope • Interest rate • Uncertainty • Investment • Stock • Warren Buffett • Value investing • JPMorgan Chase • Financial institution • Price • Corporation • JPMorgan Chase • Seeking Alpha • Corporation • Stock •