A 50 Bps Rate Cut: Be Careful What You Wish For - 4 minutes read

A 50 Bps Rate Cut: Be Careful What You Wish For

A 50 Bps Rate Cut: Be Careful What You Wish ForWhile the market is hoping for the best, i.e. a 50 bps rate cut...

However, according to Oppenheimer, a 0.5% interest rate cut will lead to a recession in the US.

In a recent article, we've presented the Fed's dilemma when it comes to how much (and how quickly) rates should be lowered.

As I write this, the market is pricing the following probabilities ahead of the July 31st FOMC meeting:

While the market is preparing for the "worst", i.e. "only" 25 bps cut, many investors are still hoping for the best (outcome), i.e. a 50 bps cut. Thing is that those investors wishing for a 50 bps rate cut should be more minded regarding what they are wishing for.

Why so? Because history suggests that a 50 bps might lead to panic and lack of confidence, while a 25 bps cut seems like a solid move by the Fed, ahead of a potential slowdown to the economic cycle.

Oppenheimer's technical strategist, Ari Wald, examined the past nine events of initial interest rate cuts over the past 50 years: 1973, 1979, 1981, 1984, 1989, 1995, 1998, 2001 and 2007. His conclusion? A 0.5% reduction is likely to signal that the US is entering a recession within 12 months.

A reduction of the interest rate by 0.25% or less did not lead to an economic slowdown. On the contrary, over the period of 3, 6 and 12 months post the initial interest rate cut, the S&P 500 (SPY) recorded a positive return. However, when the Fed reduced the interest rate by (at least) 0.5%, the US economy entered into a recession in all cases but one. Furthermore, the S&P 500 posted a double-digit negative total return during the subsequent 12 months, following the initial rate cut.

Wald sees the current situation being more similar to the situation in 2016, when a sharp decline in long-term bond yields increased investors' appetite for risk assets and high beta shares.

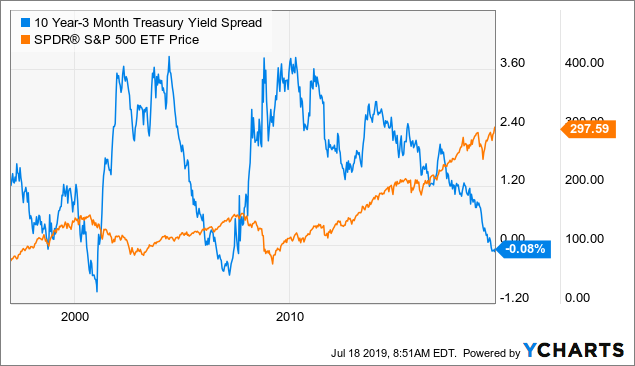

Wald goes further in explaining that unlike the situation in 2016, where the spread between 10-year and 3-month yields was positive and thus supported "value"-oriented investment channels (IWN), the current state of a declining yield curve supports "growth"-oriented investment channels (IWO) that can deliver decent total returns even under a moderate economic growth environment.

At the same time, he notes that an inverted yield curve is not usually a negative indication for the stock market, as the timing of inversion isn't historically correlated with the stock market uptrend/cycle.

While I respect Wald's opinion, when I look at the past 20 years, an inversion of the 10-year/3-month spread has led - sooner rather than later - to a major change in the market sentiment.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Basis point • Be Careful What You Wish For... • Basis point • Interest rate • Recession • Federal Reserve System • Market (economics) • Probability • Federal Open Market Committee • Basis point • Basis point • Basis point • Basis point • Basis point • Business cycle • Technology • Interest rate • Reductionism • Recession • Interest rate • Recession • Interest rate • S&P 500 Index • Espionage • Rate of return • Federal Reserve System • Interest rate • Economy of the United States • Recession • S&P 500 Index • Long-Term Capital Management • Bond (finance) • Yield (finance) • Investor • Risk • Asset • Beta (finance) • Share (finance) • Yield spread • Yield (finance) • Value (economics) • Investment • Yield curve • Investment • Economic growth • Yield curve • Deflation • Stock market • Invertible matrix • Stock market • Market sentiment • Stock market • Seeking Alpha • Stock market •