Amazon has been on a spending spree, preparing for the future as revenue growth slows - 5 minutes read

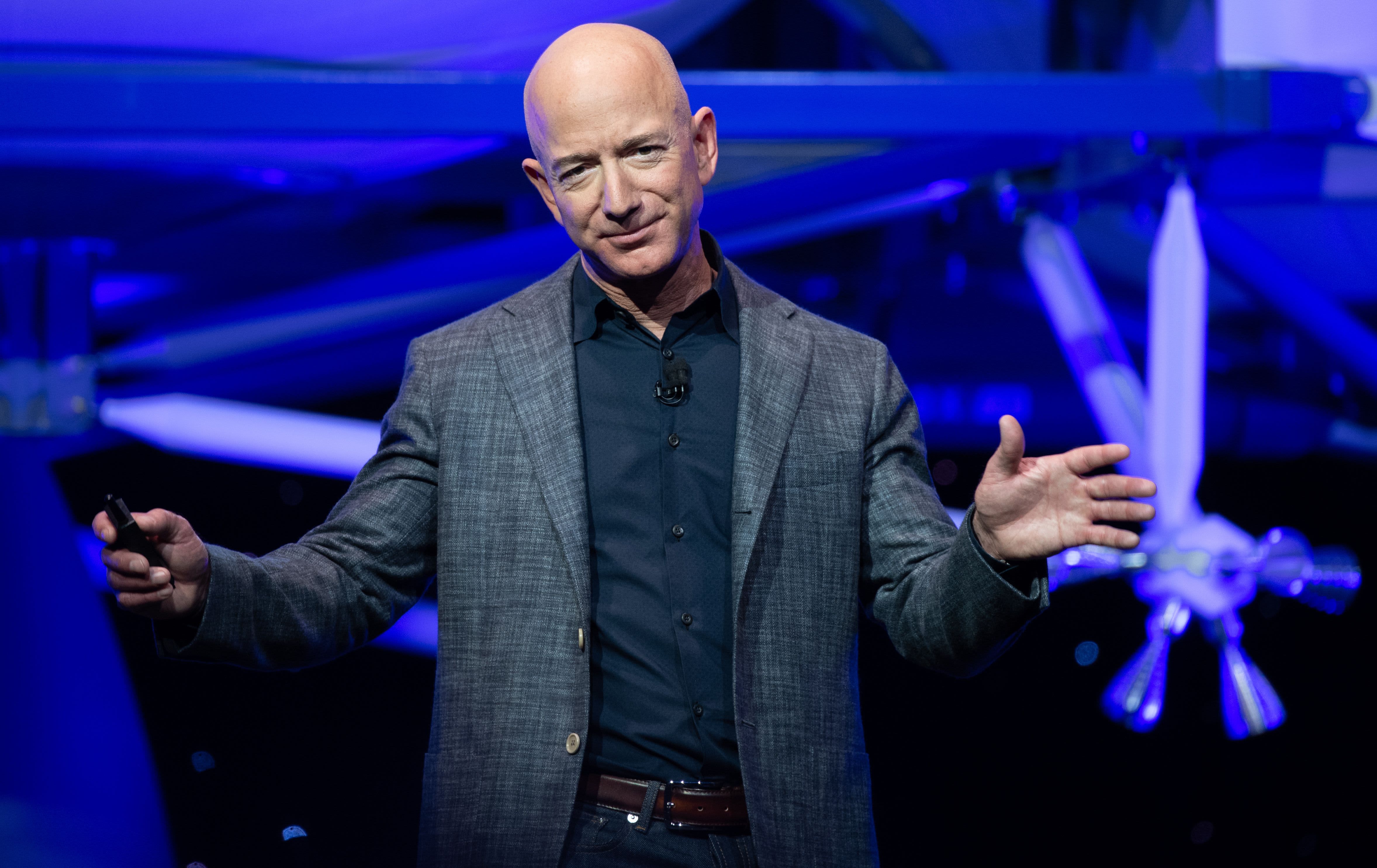

Jeff Bezos announces Blue Moon, a lunar landing vehicle for the Moon, during a Blue Origin event in Washington, DC, May 9, 2019.

Saul Loeb | AFP | Getty Images

Amazon has been gradually racking up investments to position itself for the future as its core business slows.

Within the past year alone, Amazon has announced more than half a dozen major investments representing billions of dollars. The investments primarily focus on new delivery businesses and logistics, but also include other areas like its investment in a new headquarters. Amazon made clear its ambitions in the transportation and logistics space by identifying such services as potential competitors in a regulatory filing earlier this year.

The spending spree comes as Amazon has been serving up big profits despite slowing revenue growth. The company reported a huge beat on earnings in the first quarter of 2019 at $7.09 per share, but saw revenue growth decelerate across the board. Its 16.9% revenue growth represented the slowest increase since the first quarter of 2015.

Amazon's growth has been largely buoyed by its cloud business, Amazon Web Services, which has become a major profit driver for the company. In the first quarter of 2019, AWS revenue represented 13% of total sales for Amazon, up from 10% from the previous quarter. But even AWS, which reported 41% revenue growth, has seen its growth decelerate compared to its 49% sales increase the previous year.

Now that Amazon is making money, it's putting those dollars back into new ventures. But its investment strategy stands out among its tech peers for both its scale and style. While Apple CEO Tim Cook told CNBC his company quietly buys a new business every few weeks, Amazon's investments are far flashier. Cook said most of Apple's acquisitions go unannounced because their main purpose is to gain intellectual property and talent.

Meanwhile, Facebook has largely focused its efforts internally as it tries to gain back users' trust after a year of scandals with a product roadmap geared toward privacy features. Alphabet continues to invest in its "Other Bets" outside of Google, like drone delivery and self-driving cars, but they still represent a small portion of revenue.

Here are the most notable investments Amazon has made over the past year:

PillPack

Amazon took a major step into the medicinal space in June 2018 when it announced it was buying online pharmacy PillPack for what was later revealed to be a $753 million purchase. The company, which delivers medications in packets that remind consumers when they are supposed to take them, expanded Amazon's delivery prowess into a new vertical.

Amazon has taken an interest in health care, teaming up with Berkshire Hathaway and JPMorgan Chase early last year to form a partnership to cut costs for their employees. But its acquisition of PillPack shows its interest extends beyond its own employee benefits and into a new business opportunity.

HQ2 and other office expansions

Amazon pledged a $5 billion economic investment for its second headquarters, which it ultimately split between two locations in Northern Virginia and New York. Even once it backed out of the New York deal following local and political backlash, Amazon said it would move move forward with its plans in Northern Virginia as well as for its new Operations Center of Excellence in Nashville, where it pledged a $230 million investment.

The company said it would continue to grow across its 17 corporate offices and tech hubs in North America as well, and has since announced several expansions including in Denver and Austin.

Aurora

Amazon invested an undisclosed amount into self-driving car start-up Aurora earlier this year. Sequoia Captial and Shell's investment arm were also among the investors in the $530 million funding round announced in February.

The investment could represent an opportunity for Amazon to further widen its margins in the future. Although Amazon has not publicly disclosed plans for the investment, it's not hard to imagine the company's interest in self-driving technology. Amazon spent more than $27 billion on delivery costs in 2018, which could eventually be cut down by eliminating drivers and third-party delivery companies from the equation.

"Autonomous technology has the potential to help make the jobs of our employees and partners safer and more productive, whether it's in a fulfillment center or on the road, and we're excited about the possibilities," Amazon said in a statement to CNBC at the time of the announcement.

Rivian

Another way to cut down on delivery costs could be by reducing energy spending. Amazon led a $700 million investment round in electric truck start-up Rivian, which was announced in February shortly after the Aurora funding became public. The investment in a the potential Tesla rival reaffirms Amazon's ambitions in the sustainable transportation space.

Air

Amazon is also looking to the sky when it comes to transportation and logistics. The company expanded Amazon Air to include 50 planes and new regional hubs. Amazon said it would invest $1.5 billion into a new hub in northern Kentucky it plans to open in 2021.

The investment is helping Amazon bring more of its logistics in house and reducing its reliance on third-party shippers like UPS and FedEx. Wolfe Research estimated earlier this year that Amazon handles its own shipping for 26% of online orders.

Project Kuiper

Amazon CEO Jeff Bezos' interest in space is widely known — he has an entire other company dedicated to space exploration, after all.

But Amazon has also expanded its ambitions beyond Earth's atmosphere with Project Kuiper. Amazon plans to set up a network of over 3,000 satellites to expand high-speed internet access worldwide, the company confirmed after the plans were revealed a regulatory filing in April.

Although Amazon has not provided cost estimates for the project, several space executives previously told CNBC the project would likely cost at least $3 billion. But the long-term payoff for Amazon could be substantial since the more people it connects to the internet, the more potential customers it has for its services. Elon Musk's SpaceX also has plans to launch internet-beaming satellites.

Deliveroo