Berkshire Hathaway will get 'a little more liberal in repurchasing shares,' Charlie Munger says - 2 minutes read

Berkshire Hathaway Chairman Warren Buffett and Vice Chairman Charlie Munger are seen at the annual Berkshire shareholder shopping day in Omaha, Nebraska, U.S., May 3, 2019.

Scott Morgan | Reuters

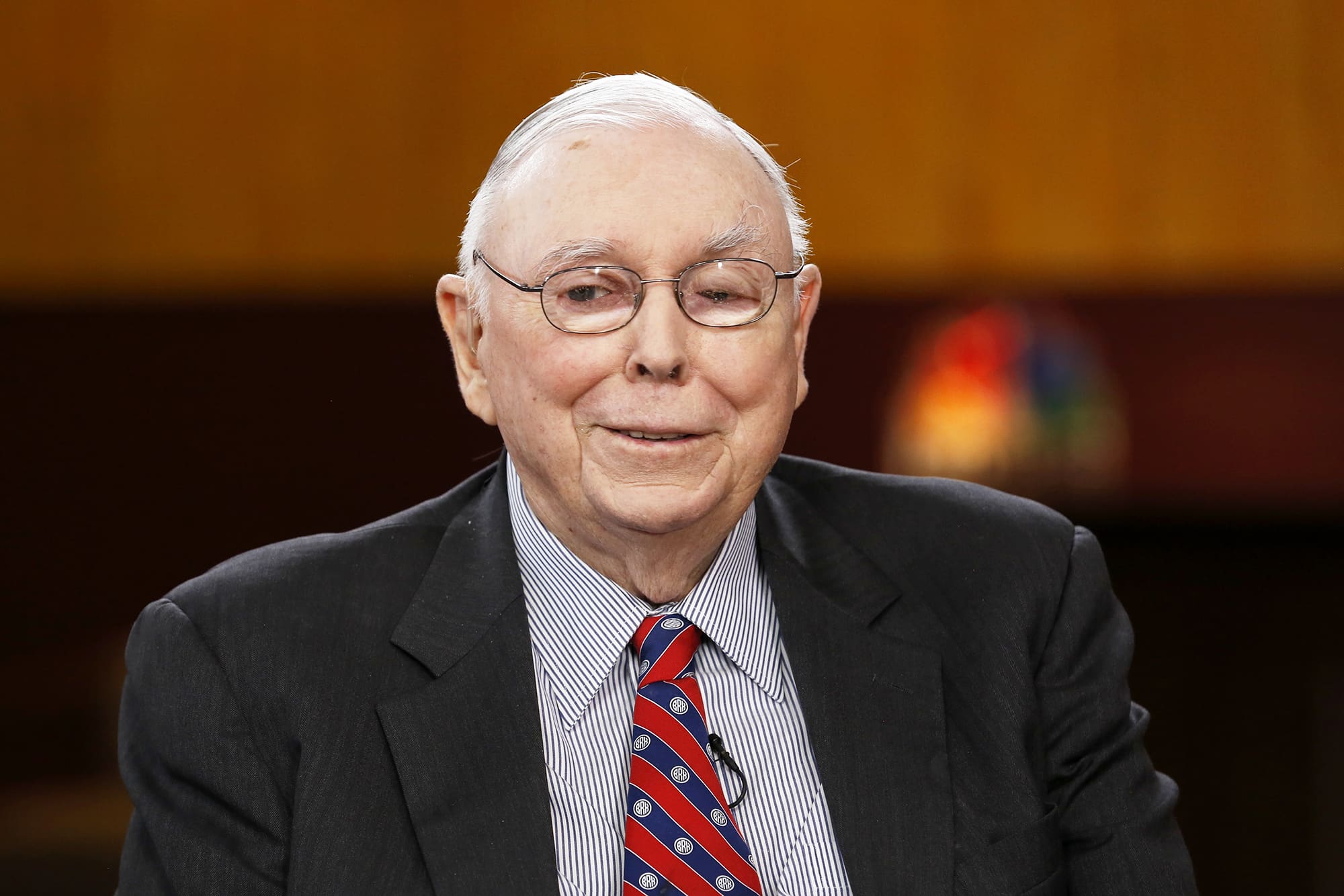

Berkshire Hathaway vice chairman and Warren Buffett's longtime partner Charlie Munger hinted that the company may be a little more aggressive in buying back its own stock.

"I predict we'll get a little more liberal in repurchasing shares," Munger said Saturday during a Q&A session at Berkshire's annual meeting at the CHI Health Center in Omaha, Nebraska.

The conglomerate repurchased $1.7 billion of shares in the first quarter, according to the company's earnings report released on Saturday. Shares of Berkshire fell 1.6% in the first three months of 2019 after posting a small gain of 3% in 2018.

Buffett acknowledged that share buybacks are a good use of corporate cash and are beneficial to Berkshire shareholders, who are hungry to see the investor more aggressively deploy its $110 billion in cash in some fashion.

But Buffett said that just because he happens to have a lot of cash at this time, it won't influence when he chooses to buy Berkshire stock.

"Whether we have $100 billion or $200 billion wouldn't make a difference in our approach of repurchase of shares," Buffett said Saturday. "We want to be sure when we repurchase shares, that people who have not sold their shares are going to be better off."

Berkshire swung to a big profit in the first quarter, posting overall profit of $21.66 billion compared with a year-earlier net loss of $1.14 billion. The results were boosted by gains in its stock investments.