The Fed will have a hard time giving everyone what they want, from stock traders to Trump - 5 minutes read

This just might be Fed Chair Jerome Powell's toughest meeting yet, because whatever the outcome, odds are high that it will disappoint a large group of people, and that's not even counting President Donald Trump.

The Fed began its two-day meeting Tuesday, and by 2 p.m. ET today, markets will be pouncing on whatever the Fed has decided on interest rates, future rate cuts and the state of the economy. Most economists expect the Fed to pass on cutting rates, but move to a tone in its statement and in its forecasts that suggest a rate cut is coming, which many believe will be in July.

That's where it gets tricky. The Fed now says it is "patient," willing to watch the incoming data and weigh what to do about policy. But after Fed officials signaled in various comments that they could cut rates, the markets now anticipate a new rate cutting period. That means the Fed will also likely transition from being "patient" to becoming something else. What other language it uses could determine how dovish or hawkish the market will believe it to be.

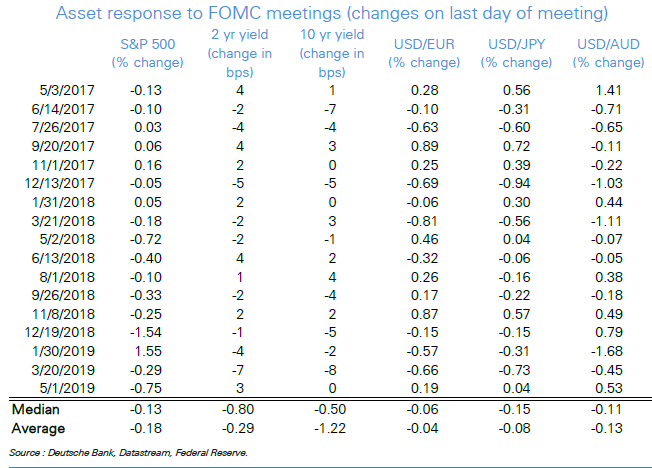

"With the market pricing in a 1 in 5 chance of a rate cut for the current meeting, and a 100% probability of a 25 [basis-point] cut at the July meeting, it is relatively easy for the Fed to disappoint risky assets," notes Alan Ruskin, head of G-10 foreign exchange strategy at Deutsche Bank. "The biggest dilemma for the Fed is how to maintain maximum policy 'optionality' for July without having risky assets reprice sharply negative."

In fact, a negative 'reprice' of risk assets — or simply a stock market sell-off — has been the norm for the Fed meeting day since Powell took over from former Fed Chair Janet Yellen. Ruskin notes that after all of Powell's 10 meetings, the S&P 500 was lower on nine of them.

Source: Deutsche Bank

"If the Fed shows considerable flexibility and a strong bias to cut rates in July, but is some way from pre-committing because they are data and politics dependent, it would be expected that the [dollar] will be stronger against almost all currencies," Ruskin wrote. The Fed's next rate cut will be its first since it cut rates to zero in late 2008.

Powell speaks to the press at 2:30 p.m. ET, following the meeting, and he could use that time to clarify the Fed's message.

"I know he's Mr. Volatility ... he tends to generate a lot of volatility," said Ward McCarthy, chief financial economist at Jefferies. "Who knows, especially coming on the heels of Draghi's comment and Trump's tweet. Almost no matter what he does is going to surprise someone." McCarthy is in a minority of Street economists not expecting the Fed to cut rates this year.

On Tuesday, European Central Bank President Mario Draghi laid out a framework for the ECB saying it could buy more assets and even cut its negative rates. Those comments sent German and French yields into record negative territory and the U.S. 10-year close to 2%. Draghi was seen as adding pressure on the Fed to be more aggressive about easing, since he widened the gulf between U.S. and European rates.

In a tweet, Trump criticized the ECB for moving to easier policy since it would send the euro lower against the dollar. He also criticized the Fed again Tuesday for not easing, and when asked if he'd demote Powell, he said: "Let's see what he does."

McCarthy said the Fed could be very clear that it has options by changing the message on its 'dot plot' chart, literally a chart it uses to show what individual, but anonymous, Fed officials see as the path of the fed funds rate. The dot plot still shows higher rates next year, and McCarthy said that could change.

"The Fed has been trying to get optionality since last December. I think they'll achieve that today but have the dot line flatline. You still have a positive slope.They'll take that slope out," McCarthy said. "For the most part, that puts the ball in Trump's court because it's trade negotiations that will determine things. Trump may get what he wants in lower rates, and it will be because he drops the ball."

Bespoke also studied market moves post-Fed meeting and found the string of stock declines after Powell meetings to be a bit unusual.

"While the S&P usually trades higher on Fed Days, over the last 10, the S&P has averaged a decline of 0.30%. Aside from the S&P's 1.55% gain on the day of the January 2019 meeting, the S&P has fallen on 9 of the last 10 Fed Days. As shown in the chart below, there have only been three other periods over the last 25 years where the rolling 10-Fed Day average % change for the S&P has dipped into negative territory for multiple months like it has recently — early 2001, early 2006, and early 2014," Bespoke noted.

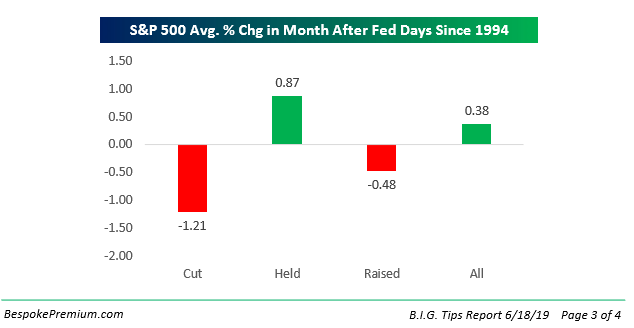

The firm also noted that when the Fed does make a move, either raising or cutting interest rates, the S&P averages declines in the month following those moves. But it has averaged a gain of 0.9% in the month after the meetings where it has not made rate changes.

"The Fed has left rates unchanged for two consecutive meetings, and in the month following each of the last two, the S&P gained 4.17% and 2.97%, respectively. A Fed on hold suggests that things are running smoothly, and that's just what the market tends to like — not too hot or not too cold," Bespoke wrote.