Impact On The Dollar And Euro If The Fed Cuts Rates - 4 minutes read

Impact On The Dollar And Euro If The Fed Cuts Rates - Invesco CurrencyShares Euro Trust ETF (NYSEARCA:FXE)

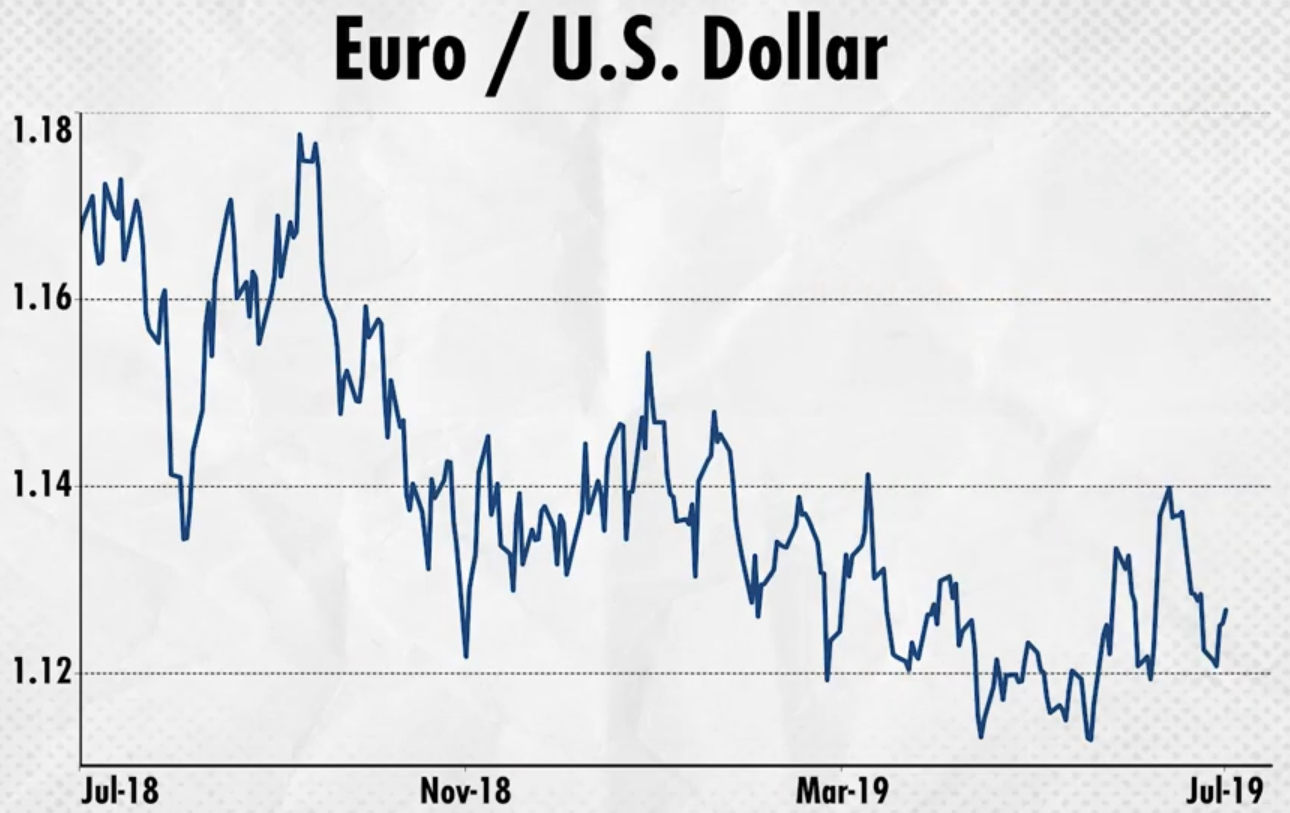

Impact On The Dollar And Euro If The Fed Cuts Rates - Invesco CurrencyShares Euro Trust ETF (NYSEARCA:FXE)He likes shorting the euro against the dollar at current levels, with a stop-loss at 1.15 and a target between 1.05 and 1.07 by the end of the year.

While the Fed is about to cut rates, the dollar should actually strengthen from here, FXStreet analyst Joseph Trevisani told Real Vision viewers on Trade Ideas.

"The US economy is still doing better than everybody else," he explained to Real Vision's Jake Merl. "And the Fed rate cut at the end of the month, if it happens, is fully priced in. Everybody's priced it in for months now."

On the other hand, the European Central Bank is only beginning to talk about rolling out fresh stimulus, but it's "not at the operational level yet," said Trevisani. "When it starts to loom, it would play to the dollar strength and lower the euro."

Trevisani likes shorting the euro against the dollar at current levels.

"I'm looking at between 1.05 and 1.07 by the end of the year," he said. "Given the trends that we're seeing, both as far as the central bank rates go and also the world economy, that seems likely."

Trevisani said he would put a stop-loss on the trade at about 1.15, adding: "If you get to that point, then there has been a serious alteration in the underlying economics and the underlying rate policy, so something has changed."

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is pretty obvious, but we should probably say it anyway so that there is absolutely no confusion… The material in REAL VISION GROUP video programs and publications (collectively referred to as “RV RELEASES”) is provided for informational purposes only and is NOT investment advice. The information in RV RELEASES has been obtained from sources believed to be reliable, but Real Vision and its contributors, distributors and/or publishers, licensors, and their respective employees, contractors, agents, suppliers and vendors (collectively, “Affiliated Parties”) make no representation or warranty as to the accuracy, timeliness or completeness of the content in RV RELEASES. Any data included in RV RELEASES are illustrative only and not for investment purposes. Any opinion or recommendation expressed in RV RELEASES is subject to change without notice. RV Releases do not recommend, explicitly nor implicitly, nor suggest or recommend any investment strategy. Real Vision Group and its Affiliated Parties disclaim all liability for any loss that may arise (whether direct, indirect, consequential, incidental, punitive or otherwise) from any use of the information in RV RELEASES. Real Vision Group and its Affiliated Parties do not have regard to any individual’s, group of individuals’ or entity’s specific investment objectives, financial situation or circumstances. RV Releases do not express any opinion on the future value of any security, currency or other investment instrument. You should seek expert financial and other advice regarding the appropriateness of the material discussed or recommended in RV RELEASES and should note that investment values may fall, you may receive back less than originally invested and past performance is not necessarily reflective of future performance. Well that was pretty intense! We hope you got all of that - now stop reading the small print and go and enjoy Real Vision.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

United States dollar • Euro • Federal Reserve System • Invesco • Euro • Exchange-traded fund • Euro • United States dollar • Order (exchange) • Federal Reserve System • Trade • Economy of the United States • Federal Reserve System • Interest rate • European Central Bank • Euro • Euro • United States dollar • Central bank • World economy • Order (exchange) • Trade • Economics • Interest rate • Stock • Seeking Alpha • Corporation • Information • Distribution (business) • Employment • Independent contractor • Law of agency • Supply chain • Distribution (business) • Data • Opinion • Punishment • Information • Reality • Individual • Entity • Investment • Finance • Opinion • Future value • Currency • Investment • Expert • Finance • Investment • Value (ethics) •