How Facebook’s Libra is similar in concept and motivation to Kik’s Kin cryptocurrency – TechCrunch - 4 minutes read

Facebook unveiled its Libra cryptocurrency initiative today, which is part of an alternative financial system (including new subsidiary and wallet ‘Calibra‘) it aims to build alongside industry and academic partners including MasterCard, PayPal, Visa, Uber, Andreessen Horowitz and Creative Destruction Lab. Facebook’s plans for Libra sound ambitious, risky and novel – but a predecessor exists that can shed light on some of the company’s motivations, and possibly the shape it wants the project to ultimately take.

I’m talking about Kik’s Kin, the other cryptocurrency created by a social network. Kin is likely most well-known for being the subject of a current SEC lawsuit, which specifically targets the initial coin offering (ICO) Kik ran in 2017 around the currency to generate capital. The SEC filed suit earlier this year, claiming that the $100 million offering was illegal because it was not registered with the agency.

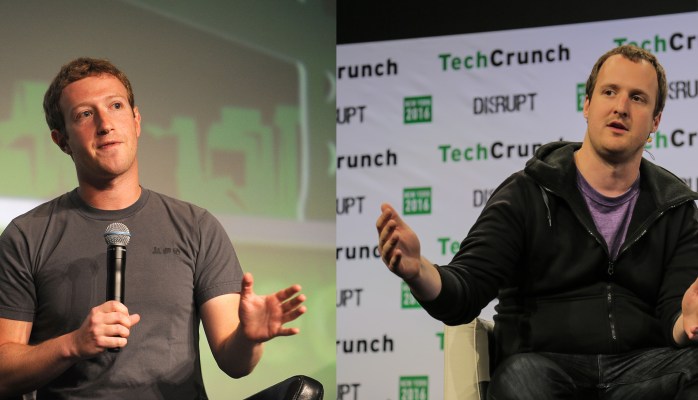

Leaving aside the merits of the lawsuit against Kik (CEO Ted Livingston contends that it’s down to a fundamental disagreement over whether cryptocurrencies are currencies with utility value – Kik’s position – or securities subject to securities regulation – current SEC thinking), Kin provides a lot of insight into what Facebook is doing with its own cryptocurrency play, and why.

Speaking at Creative Destruction Lab’s Super Session event during a fireside last week, Livingston said that Kin was originally created to address the very specific challenge Kik had of “we need to make money.” Kik tried a few different models, including a “Cards” concept that was essentially trying to set up an app ecosystem within a messaging platform in a North American context, much like the WeChat model works in China.

Kik, while never having achieved anywhere near the scale of a Facebook, has had periods of impressive success and growth in terms of its user community (albeit with some valid questions around the quality and make up of those active on the network). Despite strong user numbers, however, the company never pursued the kind of advertising-based revenue model embraced by Facebook, and so in 2011, when Kik “learned about Bitcoin,” the company though “this might just be the business model we were looking for,” according to Livingston’s recounting of Kin’s origins.

The Kik CEO said that Kin made sense because it’s an effective, easy way for people on the platform to quickly and easily exchange value, something they said was organic for their community because they see a lot of naturally-occurring communities where experts provide their expertise to others with similar interests (ie., taking care of succulents or cooking). Blockchain -based Kin allowed enabled them and their developers to both guarantee the scarcity of a digital asset, and to move it around easily without having to trust an intermediary.

For Kik, the key was that this meant that use of Kin set up a mutually beneficial incentive model in which Kik was generally incented to boost use of Kin, as were developers, since it operated in their own interests as well – meanwhile, users were incented bc of Kin’s use value. The interest alignment, for Livingston, was crucially different from an advertising-based model which can cause severely misaligned incentive structures for all parties involved, as we’ve seen.

Everything that Livingston pointed out about Kin is likely true for Libra, too – the major difference between the two companies are their scale, stage of growth, and economic power. Kik turned to cryptocurrency as a revenue model because it needed one, and needed one more or less immediately (which led to the ICO piece). Kik also didn’t have the market-mover ability to enlist such big name partners at launch – it needed to hit the ground running and hope partners would come along after demonstrating community traction.

Facebook has the industry weight to bring in collaborators early, and partners don’t really need any motivation beyond not wanting to suffer the opportunity cost if it works out. They also have plenty of runway in terms of their existing business model: Advertising. But underlying the Facebook and Kik plans seems to be a fundamental similarity – an assumption that eventually, a revenue model based on something other than advertising could be more sustainable, or more palatable to consumers. The question to answer will be whether and when Facebook’s efforts here switch from being a hedge to a necessary commitment to ensure survivability.