{Devaluation} Amex Simply Cash Replaced by 2% Cash Back Card & Why It Is A Pass - 4 minutes read

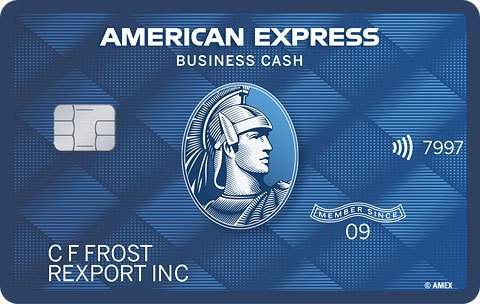

Amex Simply Cash Replaced by Amex Blue Business Cash

Amex Simply Cash Replaced by Amex Blue Business CashAmerican Express has a new business credit card. It’s called the Amex Blue Business Cash Card. This is a 2% cash-back credit card that comes with no annual fee. It’s essentially a Blue Business Plus card that earns cashback instead of points. It also takes the place of the SimplyCash Plus card in the American Express card lineup which is a devaluation.

First let’s look at the welcome offer, wait there is none! You could refer yourself to it for a bonus but that will likely get clawed back.

New cardmembers only get 0% APR for the first 12 months on purchases and balance transfers. Hopefully we will see some kind of offer soon. I’d expect it to be somewhere between $100 and $200.

Now let’s take a look at the card features.

American Express has confirmed that the Amex SimplyCash Plus card will no longer be available as of July 18, 2019. But they also said that the new Amex Blue Business Cash card is considered a brand new product. So it’s not related to Amex SimplyCash Plus at all. That’s helpful in case they come out with a welcome offer for the new card.

Brett Sussman, Vice President, Global Commercial Card Lending at American Express provided the following statement:

“The Blue Business Cash Card is a completely new card. Current SimplyCash Plus Card Members will not be impacted by the introduction of the Blue Business Cash Card. We will stop acquiring new Card Member accounts on the SimplyCash Plus Card on July 18. Existing SimplyCash Plus Card Members will still be able to add employee cards to their existing account. Current SimplyCash Plus Card Members can call to product transfer to the new Blue Business Cash Card if they would like.”

But it is essentially taking the spot of SimplyCash card which is bad for us. The SimplyCash card was a great option for anyone not able to get a Chase Ink Cash card since it earned 5% back at office stores and on cell service. You could also earn 3% back on one of 8 categories, you chose which one you wanted. Some of the options were gas stations, shipping, advertising etc.

As you can see the SimplyCash was the better card and it would often have welcome offers of up to $500.

There is a huge market for 2% cash back cards, just look at Capital One‘s business portfolio and how well they do. But to cap the earning at $50,000 per year doesn’t make sense to me. I get it on the Blue Business Plus since you are earning Membership Rewards that are transferable for no annual fee, but for cashback? Amex’s swipe fees far exceed 2%, especially on a business card that usually gets higher than normal rates, so why cap it?

It comes with no annual fee which is an advantage over similar cards from Capital One but Capital One cards don’t cap earning and they come with a $500 welcome offer. I would take that combo any day of the week over this offer.

If you were considering this card do yourself a favor and get the Blue Business Plus instead!

Source: Boardingarea.com

Powered by NewsAPI.org

Keywords:

American Express • American Express • Business • American Express • Business • Credit card • American Express • Business • ATM card • Credit card • Hachette Book Group • Cashback reward program • American Express • Credit card • American Express • American Express • American Express • ATM card • American Express • Credit card • Vice president • Multinational corporation • Commercial bank • Loan • American Express • Financial statement • Business • ATM card • ATM card • Deposit account • Transfer payment • Business • ATM card • Option (finance) • ATM card • Retail • Service (economics) • Filling station • Advertising • Marketing • Capital One • Get It On (Intenso Project song) • Hachette Book Group • Cashback reward program • American Express • Business card • Capital One • Take That • Business Plus (TV Channel) •