The S&P 500's Hottest Stock, Coty, May Be Running Out Of Steam - 10 minutes read

The S&P 500's Hottest Stock, Coty, May Be Running Out Of Steam - Coty Inc. (NYSE:COTY)

The S&P 500's Hottest Stock, Coty, May Be Running Out Of Steam - Coty Inc. (NYSE:COTY)Behind the huge rally in COTY stock is a belief that management is taking all the right steps to improve the company's medium to long-term profit growth potential.

But, this improvement is already fully priced into COTY stock, and further upside will likely be capped by valuation friction.

Good timing and strong tailwinds have combined to push the S&P 500 up nearly 18% year-to-date through the back half of June. That's a big rally. Indeed, it's the most the S&P 500 has rallied to start a year through mid-June since 1997, meaning stocks are broadly having their best year in over two decades.

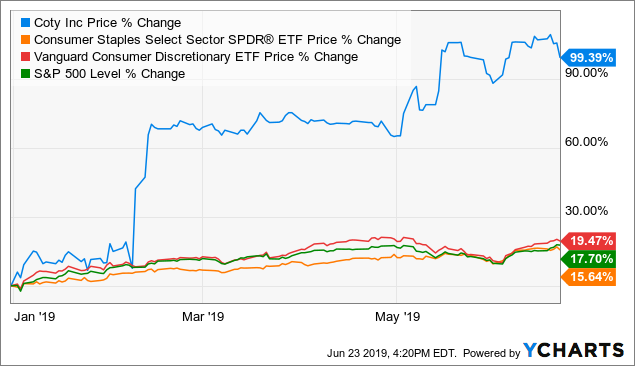

The top-performing stock in the S&P 500 in this record year is global cosmetics giant Coty (COTY). COTY stock has essentially doubled in 2019. The next biggest year-to-date gainer? Xerox (XRX), with a sub-80% year-to-date again. After those two, no other S&P 500 stock has rallied more than 70% in 2019. Also of note, consumer discretionary and consumer staples stocks are both up less than 20% year-to-date.

In other words, not only has COTY stock been on fire in 2019, but it's also been way more on fire than any other S&P 500, consumer staples, or consumer discretionary stock. Naturally, the question now is whether or not this big out-performance in COTY stock can continue.

We don't think so. From where we sit, it actually looks like the S&P 500's top-performing stock so far this year, is starting to run out of steam, and likely won't head much higher into the end of year. The fundamentals here are improving, but the stock has rushed ahead of itself, and the valuation now prices in too much optimism regarding an operational turnaround. Global economic noise in the back-half of calendar 2019 will challenge this company's improving trends, and cause investors to reconsider the underlying valuation here. As they do, the stock will likely struggle for gains.

In simple terms, Coty is a rebound story. The company sells various cosmetic products through three lines: Luxury Beauty (which mostly includes premium fragrances, like Hugo Boss cologne), Professional Beauty (which mostly includes hair and nail care products for salon professionals, like Wella Professionals), and Consumer Beauty (which mostly includes hair styling and care products and mass market fragrances). The global physical cosmetics industry has been under pressure over the past several years as e-commerce encroachment and department store discounting have created a tough pricing environment with depressed traffic trends.

A subtle consumption shift toward more organic-based products has also hurt the traditional beauty industry. Net-net, Coty's Luxury, Consumer, and Professional Beauty lines have all had their fair share of struggles over the past several years. Organic revenues have dropped, margins have compressed, and profits have declined.

But, management has been taking all the right steps over the past several quarters to moderate these declines. These steps revolve around the motto "better before bigger."

In prior years, Coty has been a company all about "bigger," and the company's history is full of acquisition after acquisition which have together created a near $10 billion revenue global beauty conglomerate. The problem with that strategy is that Coty spread itself too thin among too many different and non-distinct brands, so as competition in the cosmetic and personal products space has become more fierce over the past several years, Coty's many non-distinct brands have lost share to more distinct and relevant beauty brands. This also caused margin erosion, and profit declines, all against the backdrop of a levered balance sheet which become so absorbed with debt because of acquisitions. The result? A stock price that dropped 80% from June 2015 to the beginning of 2019.

Now, though, "better" is the goal, not "bigger." Management has become obsessed with stabilizing and improving margins, and as such, has re-allocated resources from expanding the brand portfolio, to improving individual brand equity. This has resulted in Coty's brands becoming more relevant and distinct. Management has also exercised disciplined cost control, leveraged fixed expenses, improved existing shelf productivity, reduced SKU complexity, and adopted a data-first approach to business decision making. All those initiatives have laid the groundwork for Coty to improve medium to long term revenue and profit growth trends.

These improvements have already started to materialize. Organic like-for-like (or LFL) sales growth was positive in fiscal 2018 for the first time since fiscal 2013, and while LFL sales growth has been volatile this year, the underlying trends are improving. The Luxury business is firing on all cylinders, and back to growing at a steady pace. The Professional business is stabilizing. The Consumer business remains weak, but through SKU optimizations and a more concentrated focus on improving brand equity, this business has the potential to follow a similar improvement trajectory as the Luxury and Professional businesses. Thus, Coty is presently in the process of going from a negative organic revenue growth company, to a flat to potentially positive organic revenue growth company.

Meanwhile, adjusted operating margins have been making upward progress, too. Adjusted operating margins have been on a steady downward trend for several years. At the start of fiscal 2019, operating margins dropped nearly 200 basis points year-over-year, and it looked like the margin compression trend was set to continue. But, in the second quarter, margins only fell back 40 basis points. In the third quarter, operating margins actually rose year-over-year. Thus, Coty is presently in the process of going from a margin compression company, to a margin expansion company.

These two big pivots from negative to positive growth, and from margin compression to margin expansion, are behind the 100% year-to-date rally in COTY stock. As is visible in the chart below, this year is projected to be an inflection point for profits from steady erosion to steady growth, and investors are buying COTY stock up before that inflection point actually materializes.

All of this makes sense. The only problem is that investor euphoria regarding the company's turnaround efforts has thrust COTY stock into overvalued territory.

To be clear, this is not a growth company. Things are getting better. But, they still aren't great, nor do they project to be great anytime soon. LFL sales growth last quarter was -3.7%. That's not good. Sales are expected to decline this year by 8%, and top-line growth thereafter is expected to be relatively muted thanks to the company's slow growth history in its core businesses. Margins are expected to improve, but not by a tremendous amount.

All in all, this is a low single-digit revenue growth company with mild margin drivers, the sum of which should drive somewhere around mid to high single-digit profit growth. That's why the Street is modeling for ~7% profit growth per year over the next several years.

We believe mid to high single-digit profit growth is entirely doable, and further believe that $1 in EPS is achievable by fiscal 2025. We are also comfortable with the notion of COTY stock trading at 20x forward earnings at scale, given that consumer staples stocks trade around 20x forward earnings, consumer discretionary stocks trade around 20x forward earnings, and COTY's five-year average forward earnings multiple is around 20. A 20x forward multiple on $1 in fiscal 2025 EPS equates to a reasonable fiscal 2024 price target for COTY stock of $20. Discounted back by 10% per year, that implies a fundamentally supported 2019 price target for COTY stock of ~$12.50, which - not surprisingly - is right around where the consensus Street price target sits today. It's also about 5% below COTY's current stock price.

Overall, while we understand why COTY stock has been the S&P 500's top-performing stock so far in 2019, we also think that this record rally is on its last legs. The stock has sprinted ahead of the fundamentals in the near term. Over the next several months, investor euphoria will cool down, and the stock will struggle for gains. It wouldn't be surprising to see COTY stock end 2019 around the same level as where it trades today.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

S&P 500 Index • Stock • Coty, Inc. • New York Stock Exchange • Stock • Belief • Management • Company • Mass media • Profit (economics) • Economic growth • Stock • Valuation (finance) • S&P 500 Index • Rally (stock market) • S&P 500 Index • Stock • Stock market • S&P 500 Index • Multinational corporation • Cosmetics • Xerox • XRX (web application architecture) • S&P 500 Index • Stock • Luxury goods • Staples Inc. • Stock • Stock • S&P 500 Index • Luxury goods • S&P 500 Index • Stock • Value (ethics) • Optimism • Market trend • Investor • Valuation (finance) • Stock • Coty, Inc. • Company • Cosmetics • Luxury goods • Cosmetics • Aroma compound • Hugo Boss • Cologne • Cosmetics • Product (business) • Beauty salon • Wella • Consumerism • Beauty • Hairstyle • Product (business) • Cosmetics • E-commerce • Department store • Pricing • Consumption (economics) • Product (business) • Suffering • Tradition • Beauty • Industry • Luxury goods • Consumer • Cosmetics • Revenue • Profit (accounting) • Fiscal year • Company • Mergers and acquisitions • Mergers and acquisitions • Revenue • World • Cosmetics • Coty, Inc. • Brand • Personal care • Erosion • Profit (accounting) • Balance sheet • Debt • Mergers and acquisitions • Stock • Management • Brand equity • Brand • Management • Cost accounting • Productivity • Stock keeping unit • Decision-making • Revenue • Profit (economics) • Economic growth • Legends Football League • Economic growth • Finance • Finance • Legends Football League • Economic growth • Volatility (finance) • Market trend • Real estate • Business • Stock keeping unit • Brand equity • Business process • Life • Revenue • Economic growth • Company • Revenue • Economic growth • Profit margin • Market trend • Fiscal policy • Basis point • Second • Basis point • Second • Inflection point • Erosion • Inflection point • Euphoria • Company • Legends Football League • Economic growth • Public finance • Stock trader • Income • Economies of scale • Staple food • Stock • Trade • Income • Luxury goods • Stock • Trade • Income • Income • Finance • Earnings per share • Price • Stock • S&P 500 Index • Rally (stock market) • Stock • Investor • Euphoria • Stock • Seeking Alpha • Stock market •