Venmo begins piloting ‘Business Profiles’ for small sellers - 4 minutes read

Venmo is going after small businesses. The mobile-payments app announced today it’s piloting a new feature called Business Profiles, which offers small sellers and other sole proprietors the opportunity to have a more professional profile page on its platform. Sellers can share key business details like address, phone number, email, website and more.

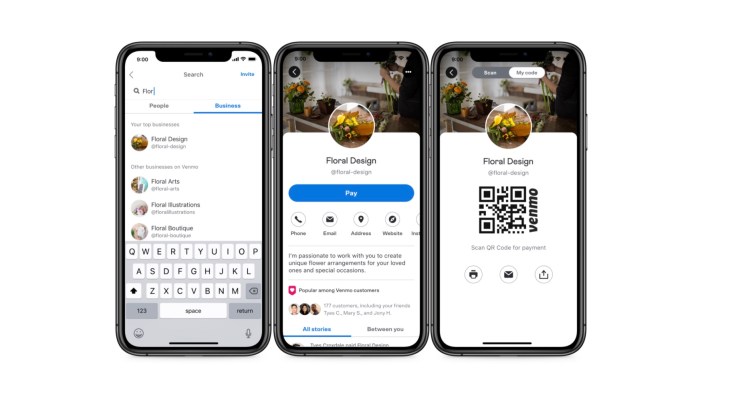

Venmo is going after small businesses. The mobile-payments app announced today it’s piloting a new feature called Business Profiles, which offers small sellers and other sole proprietors the opportunity to have a more professional profile page on its platform. Sellers can share key business details like address, phone number, email, website and more.By adopting a Business Profile, sellers will be able to raise awareness about their business through Venmo’s social feed and search, as well as keep their personal transactions separate from those for their businesses for accounting purposes.

The profiles give smaller sellers a way to do business without having to necessarily establish a larger web presence, like a Facebook Page or Google Business listing, for example.

Instead, Venmo’s Business Profiles may be better suited to sellers such as local artists, crafters, or farmer’s market booth holders, or those who casually use Venmo to support the income they receive from side-hustles, such as mowing lawns or doing neighborhood home repair jobs.

As Venmo users pay these small sellers, the payment is published to the Venmo social feed where friends or even the public can view the transaction, depending on the user’s privacy settings. Interested friends and neighbors could then click on the Business Profile to learn more about the seller, as these new profile pages also offers a space to write a short introduction to business.

They’ll also be able to see how many customers the seller has and if any of their Venmo friends have ever transacted with the seller. Sellers can also email, print out, text or AirDrop their Venmo QR code for their profile to make it easier for customers to find their business on the app.

In addition, a new Venmo Search experience would allow users to switch between a “People” and “Business” tab when looking for a particular Venmo username.

Businesses with a profile page will be able to more easily track their transactions without having to create a separate account. Instead, users will be able to switch between their personal accounts and business profiles from the same log-in.

PayPal-owned Venmo says the new feature will also offer transactional insights and information, including number of customers and a customer list.

The system would formalize what’s already a top use case for Venmo’s platform. It would also offer Venmo a way to expand its revenue opportunities. Though the service is free during the pilot, Venmo indicates that may not always be the case.

In an online FAQ about the new feature, Venmo notes that in the future, business owners would be changed a per-transaction fee of 1.9% + $0.10 on every payment made to their profile. This is still a lower fee than Square charges or even Venmo parent PayPal.

The new feature, however, isn’t just about offering a new way for sellers to transact. Because Venmo is also a social platform, sellers can tap into the network effects it provides — similar to Messenger or WhatsApp, where businesses often now have their own profiles.

The addition comes at a time when the coronavirus outbreak just took a hit on PayPal’s larger business, leading it to miss on Q1 earnings. Venmo, however, was a bright spot in terms of growth, with total payment volume in the quarter reaching $31 billion, up 48% year-over-year. PayPal had also said its net new actives hit records in April as consumers shifted to online and contactless payments — a trend that could play out further in Q2. Venmo was a big contributor to this growth and even saw its highest transactions ever on May 1.

Venmo’s Business Profiles feature is starting to pilot today with a limited number of users on iOS. It will roll out to Android in the week ahead, and in the coming months will become more broadly available.

Source: TechCrunch

Powered by NewsAPI.org