How To Trade Nike's Earnings - 6 minutes read

How To Trade Nike's Earnings - NIKE, Inc. (NYSE:NKE)

How To Trade Nike's Earnings - NIKE, Inc. (NYSE:NKE)Still, this is not a distressed company but is instead succeeding at producing high return on its branded textile business mostly outsourced to China.

Growth, sentiment, net operating assets, and many other metrics point to a high probability of a rally at earnings.

Today we are looking at trading Nike (NKE) into earnings:

Let’s start with the quick take:

Options are good here because of the concavity of the play. The downside risk is higher than the upside reward, but the probability of a rally is high, urging us into the play carefully, with options to change the payoff curve.

The complex strategy above is roughly cost-free. This is a great strategy ahead of an earnings play with probability in favor of one direction, while the payoff curve is in favor of the other. A breakout to either side produces a profit.

For a look at just how overvalued NKE is, plot the EBITDA/EV against the stock price, like so:

EBITDA/EV is 50% lower than the market average. This metric is also not growing, but dipping downward. In spite of these fundamentals, the stock has rallied, bringing it to an overvaluation that can easily lead to a large selloff with the right catalyst.

Right now, we have multiple potential downward catalysts. We have tariff threats and expectations of factory closures. In addition, analysts are bearish on Nike into earnings; consider the recent “playing Nike earnings” blurb published on Seeking Alpha:

Despite this concavity and negative sentiment, we have learned from many years of earnings plays that negative sentiment helps the long side of an earnings play. This is also why we have multiple attempts, should we be wrong: We can go long on Under Armour (UAA) or Foot Locker (FL), for instance, as we have found that trading earnings the opposite direction of a recent industry negative earnings reaction produces excess returns.

On that note, Nike’s two competitors that reported earlier in June both sold off on earnings:

This further pushes down expectations for Nike on earnings and enhances the upside of the bullish play over earnings. Ultimately, we must remember that we are playing an arbitrage game that involves both psychology and fundamentals. Most have a negative outlook on Nike’s upcoming earnings play, but the company has no real fundamental dangers. It is not distressed, and it is still producing large margins.

This is a company that produces an ROA of 20%, an ROE of 45%, and an ROI of 30% on shoes made in China. This is a marketing company selling a brand; it is also a company that has shown decades of stability in it producing a superior product to its competitors. Investors are buying the brand as much as the fundamentals.

And that’s not to say the fundamentals are bad. As per Hirshleifer, Hou, Teoh, and Zhang (2004), net operating assets is a useful metric in predicting future returns. Investors and analysts tend to neglect this metric because of the psychological bias toward focusing on cash profitability instead of accounting profitability.

Calculate net operating assets by dividing the difference between operating assets and liabilities by total assets. Nike’s net operating assets (annual data, as we are looking at Q4 earnings) is at a relative low. This is good, as lower net operating assets predicts higher returns.

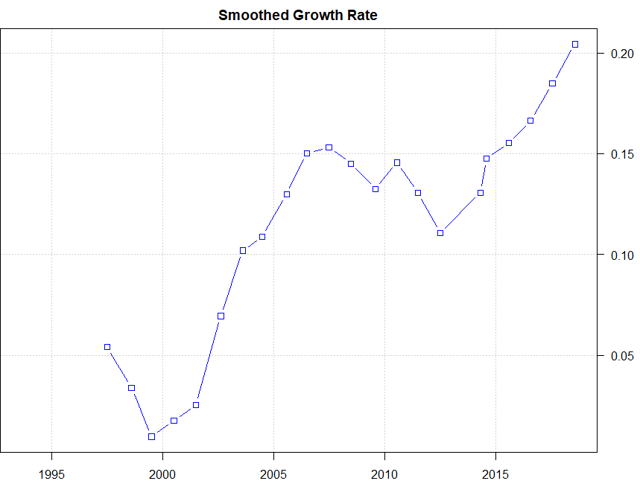

In addition, we see cash returned on invested capital continuing to rise. This is a graph the bearish analysts will be hard-pressed to explain away. Let’s look at pure growth rate first:

And here is the smoothed growth rate (running average):

EPS, too, has been growing. As a rolling average, Nike’s EPS has been rising for the last five quarters. This is a good trend at a time when sentiment is low.

As per my backtests, however, that EPS only explains 60% of NKE’s post-earnings move. The rest is mostly a difference from expectations and updated guidance. Overall, this is a high probability play with a concave payoff – but the time is right: Q4 is historically good for Nike. The last four years have produced excess gains for Nike at Q4 earnings. In addition, Thursdays tend to coincide with more earnings rallies than selloffs.

Get in on Wednesday with one of the two options plays recommended above. Happy trading!

What about after earnings? We have two ways to trade post-earnings gaps:

Earnings dates subject to change. Forward movement (sooner) implies a higher probability of strong earnings; vice-versa for backward movement (later).

Probabilities are Bayesian and weight historic earnings patterns along with AI pattern recognition.

Risk/reward measured without respect to probability and weights upside/downside.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Trade • Earnings • Nike, Inc. • New York Stock Exchange • Nu Kappa Epsilon • Company • Return on investment • Brand management • Textile • Business • Outsourcing • China • Economic growth • Net operating assets • Probability • Nike, Inc. • Nu Kappa Epsilon • Downside risk • Probability • Option (finance) • Probability • One Direction • Profit (economics) • Nu Kappa Epsilon • Earnings before interest, taxes, depreciation, and amortization • Enterprise value • Stock • Earnings before interest, taxes, depreciation, and amortization • Enterprise value • Fundamental analysis • Valuation (finance) • Catalysis • Tariff • Market trend • Nike, Inc. • Nike, Inc. • Seeking Alpha • Under Armour • University Athletic Association • Foot Locker • Florida • Nike, Inc. • Competition • Nike, Inc. • Income • Market trend • Arbitrage • Game theory • Psychology • Fundamental analysis • Nike, Inc. • Earnings • Company • Fundamental analysis • Risk • Profit margin • Return on assets • Return on equity • Made in China • Marketing • Brand • Net operating assets • Futures contract • Investor • Cash • Profit (accounting) • Profit (accounting) • Net operating assets • Asset • Nike, Inc. • Net operating assets • Fiscal year • Net operating assets • Graph (discrete mathematics) • Market trend • Moving average • Earnings per share • Moving average • Nike, Inc. • Earnings per share • Nu Kappa Epsilon • Probability • Nike, Inc. • Nike, Inc. • Probability • Probability • Bayesian probability • Artificial intelligence • Pattern recognition • Probability • Seeking Alpha • Stock market •