Alibaba Cloud turns profitable after 11 years - 3 minutes read

Alibaba Cloud, the cloud computing arm of Chinese e-commerce giant Alibaba, became profitable for the first time in the December quarter, the company announced in its earnings report.

The firm’s cloud unit achieved positive adjusted EBITA (earnings before interest, taxes and amortization) during the quarter, after being in business since 2009. The milestone is in part a result of the “realization of economies of scale,” Alibaba said.

Alibaba Cloud, which incorporates everything from database, storage, big data analytics, security and machine learning to IoT services, has dominated China’s cloud infrastructure market for the past few years and its market share worldwide continues to grow. As of 2019, the cloud behemoth was the third-largest public cloud company (providing infrastructure-as-a-service) in the world with a 9% market, trailing behind Amazon and Microsoft, according to Gartner.

COVID-19 has been a boon to cloud and digital adoption around the world as the virus forces offline activities online. For instance, Alibaba notes in its earnings that demand for digitalization in the restaurant and service industry remains strong in the post-COVID period in China, a trend that benefits its food delivery and on-demand services app, Ele.me. The firm’s cloud revenue grew to $2.47 billion in the December quarter, primarily driven by “robust growth in revenue from customers in the internet and retail industries and the public sector.”

Commerce remained Alibaba’s largest revenue driver in the quarter, accounting for nearly 70% of revenue, while cloud contributed 7%.

Tencent’s cloud segment is Alibaba Cloud’s closest rival. As of 2019, it had a 2.8% market globally, according to Gartner. The industry in China still has ample room for growth, as Alibaba executive vice-chairman Joe Tsai pointed out in an analyst call from last August.

“Based on the third-party studies that we’ve seen, the China cloud market is going to be somewhere in the $15 billion to $20 billion total size range, and the U.S. market is about eight times that. So the China market is still at a very early stage,” said Tsai.

“We feel very good, very comfortable to be in the China market and just being an environment of faster digitization and faster growth of usage of cloud from enterprises because we’re growing from such a smaller base, about one-eighth the base of that of the U.S. market.”

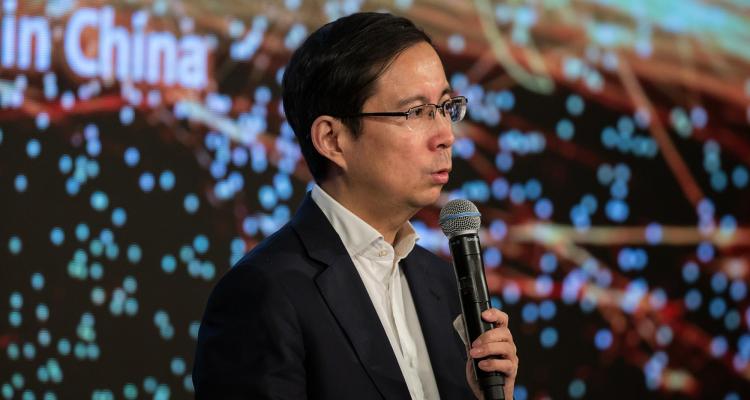

A key strategy to grow Alibaba Cloud is the integration of cloud into Alibaba’s enterprise chat app Dingtalk, which the company hopes can drive industries across the board onto cloud services. It’s a relationship that echoes that between Microsoft 365 and Azure, as president of Alibaba Cloud, Zhang Jianfeng, previously suggested in an interview.

“We don’t want to just provide cloud in terms of infrastructure services,” said Alibaba CEO Daniel Zhang in the August earnings call. “If we just do it as an infrastructure service, as SaaS services, then price competition is inevitable, and then all the cloud service is more like a commodity business. Today, Alibaba’s cloud is cloud plus intelligence services, and it’s about cloud plus the power of the data usage.”

Source: TechCrunch

Powered by NewsAPI.org