Chip stocks are tanking after 'depressing' Broadcom earnings in a bad sign for market - 3 minutes read

Broadcom led a plunge in chip stocks Friday after the chipmaker missed revenue expectations and lowered guidance for 2019 citing a "broad-based" slowdown in demand and the U.S. crackdown on Huawei.

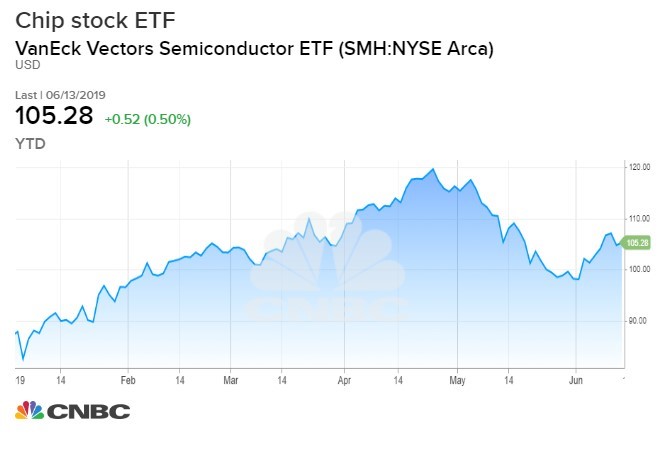

Broadcom shares lost more than 6%. Skyworks, Xilinx, Micron, Advanced Micro Devices, Nvidia and Qualcomm all followed suit with losses greater than 2%. Intel was down 0.9%. The VanEck Vectors Semiconductor ETF (SMH) dropped 2.5%.

"Growing headwinds across Broadcom's key markets (networking, storage, smartphones) finally caught up to them, triggered by the latest negative developments over trade in the past month," Morgan Stanley analyst Craig Hettenbach wrote in a note. "A broad-based slowdown and the impact from Huawei are weighing heavily on the 2H outlook, which is further compounded by customer inventory reductions – a dynamic that has kept us Cautious on the Semi industry."

Broadcom's revenue for the fiscal second quarter came in Thursday evening at $5.52 billion vs. the $5.68 billion expected by analysts polled by Refinitiv. The chipmaker also said it now expects $22.60 billion in revenue for fiscal 2019, well bellow the $24.31 billion seen by analysts polled by Refnitiv.

"We currently see a broad-based slowdown in the demand environment, which we believe is driven by continued geopolitical uncertainties, as well as the effects of export restrictions on one of our largest customers," Broadcom CEO Hock Tan said in a statement. "As a result, our customers are actively reducing their inventory levels, and we are taking a conservative stance for the rest of the year."

'Truly depressing'

"The environment is very, very nervous," Tan said later on an analyst call.

"Truly depressing Broadcom call with a solemn Hock Tan," CNBC's Jim Cramer said Thursday night.

Other technology stocks declined on concern about what the Broadcom warning means for demand for technology products. Apple and Cisco fell 0.8% and 1.8%, respectively..

Chip stocks rebounded in June in what some thought was a good sign for the market and global economy. The VanEck Vectors Semiconductor ETF was up 20% this year before Broadcom's warning. However, while the broader market, the S&P 500, has rallied to within 2% of its record, the chip stock ETF is 12% from its record reached in April, an underperformance that may have been signaling the problems coming out now with Broadcom.

The sector is sometimes seen as a leading indicator for the stock market and global economy. The broader market fell on Broadcom's warning. The Dow Jones Industrial Average lost about 100 poits in early trading while the S&P 500 slid 0.3%. The Nasdaq Composite dropped 0.6%.

— With reporting by Jordan Novet and Michael Bloom.